Your marketing agency just sent you their monthly report. It looks impressive. Website traffic is up 47%. You generated 83 leads last month. Your ads got 12,000 impressions.

Here's the problem: you have no idea if any of this actually made you money.

Most personal injury firms are flying blind when it comes to measuring marketing success. They're being fed metrics that look good on paper but mean absolutely nothing for the health of their business. Meanwhile, they're spending $10,000, $20,000, or $50,000 per month without knowing if they're generating profit or just impressive spreadsheets.

It's time to cut through the nonsense and focus on the one metric that actually tells you if your marketing is working.

Key Takeaways

CAC:LTV ROI is the only metric that tells you if your marketing is profitable—everything else is just noise

Most agencies optimise for soft metrics (traffic, impressions, clicks) because they don't want to be held accountable for actual results

Your firm and agency must be integrated—lead feedback loops are essential for marketing success

Without a proper intake process that supports the leads your agency sends, your marketing will fail regardless of quality

Benchmark for PI firms: aim for a minimum 5:1 LTV:CAC ratio, anything below 3:1 means you're losing money

Integration requires: tracking every lead source, grading lead quality, feeding data back to your agency, and optimising your intake process

The Brutal Truth About Marketing Metrics

Let me be direct with you.

If your marketing agency is reporting on website visits, impressions, click-through rates, or even "number of leads" without connecting those numbers to actual revenue, they're either incompetent or they're deliberately keeping you in the dark.

Here's why these metrics are useless on their own:

Website traffic tells you nothing about quality. You could get 10,000 visitors from people searching "free legal advice" who will never hire you. Or you could get 100 visitors from people searching "best personal injury lawyer near me" who are ready to sign. Which would you rather have?

Impressions are even worse. Your ad appeared 50,000 times? Fantastic. How many of those people had cases worth taking? How many actually called? How many signed? Without answers to these questions, impressions are just vanity metrics that make agencies look busy.

Leads can be deceiving. Getting 100 leads sounds great until you realise 90 of them are tyre-kickers with cases you'd never take. One high-quality motor vehicle accident case worth $500,000 is worth more than 50 slip-and-fall enquiries that won't even cover your costs.

The dirty secret of the marketing industry is that agencies love these soft metrics because they're easy to manipulate and hard to hold accountable. They can always generate more traffic, more impressions, more "leads." But can they generate profit? That's a completely different question.

The Only Number That Matters: CAC:LTV ROI

There's one metric that cuts through all the noise and tells you whether your marketing is actually working.

CAC:LTV ROI—the ratio of Customer Acquisition Cost to Lifetime Value.

This number doesn't lie. It tells you exactly how much you're spending to acquire a client versus how much revenue that client generates for your firm. Everything else is secondary.

Here's how it works:

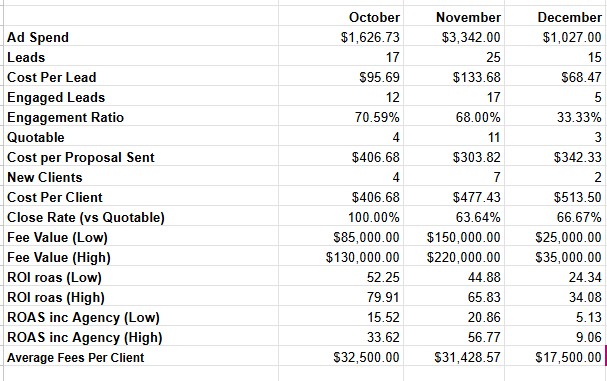

Lifetime Value (LTV) is the total revenue you generate from a client over their relationship with your firm. For personal injury, this is typically the settlement value multiplied by your fee percentage. If you settle a case for $200,000 and take a 33% fee, your LTV for that client is $66,000.

Customer Acquisition Cost (CAC) is everything you spent to get that client signed. This includes your ad spend, your agency fees, your intake team's salaries, your CRM costs—the whole lot. If you spent $15,000 in total marketing and sales costs to acquire 10 clients, your CAC is $1,500 per client.

The Ratio is simply LTV divided by CAC. Using our example: if your average LTV is $45,000 and your CAC is $3,000, your ratio is 15:1. That means for every dollar you spend on marketing, you're generating $15 in revenue.

What's a Good CAC:LTV Ratio for PI Firms?

Industry benchmarks for personal injury firms:

Below 3:1 - You're losing money. Stop everything and fix your marketing or intake process immediately

3:1 to 5:1 - You're breaking even or making modest profit, but there's significant room for improvement

5:1 to 7:1 - This is the sweet spot. You're profitable and sustainable

Above 7:1 - You're actually underinvesting in marketing. You could grow faster by spending more

Most successful PI firms operate in the 5:1 to 7:1 range. If you're consistently hitting 10:1 or higher, you're leaving money on the table by not investing more aggressively in client acquisition.

Why Most Agencies Don't Want to Talk About CAC:LTV

Here's the uncomfortable truth: most marketing agencies actively avoid discussing CAC:LTV ROI because it holds them accountable for actual business outcomes.

Think about it from their perspective. If they report on website traffic, they can always spin the numbers positively. Traffic down this month? "We're focusing on quality over quantity." Traffic up but conversions down? "The top of your funnel is strong, we just need to optimise your intake."

But CAC:LTV ROI doesn't give them anywhere to hide. Either they're generating profitable clients or they're not. Either your investment is paying off or it's not.

This is why you see so many agency reports filled with colourful charts about impressions, engagement rates, and organic reach. These metrics make agencies look productive without requiring them to prove they're actually driving profit.

The agencies that do focus on CAC:LTV ROI? They're the ones confident enough in their work to be held accountable for revenue outcomes. They're also typically the ones driving actual business growth for their clients rather than just generating activity.

The Missing Piece: Integration Between Your Firm and Your Agency

Here's where most personal injury firms fail, even when they're tracking the right metrics.

They treat their marketing agency like a vendor instead of a partner. The agency sends leads, the firm takes calls, and that's where the communication ends. There's no feedback loop. No quality reporting. No collaboration on what's working and what's not.

This is a disaster for your marketing ROI.

Your agency is optimising campaigns in the dark. They're making decisions about keywords, ad copy, and targeting based on incomplete information. They can see which ads generate clicks and which generate form submissions, but they have no idea which leads actually turned into signed cases.

Meanwhile, your intake team is handling calls without understanding which marketing sources produce the best clients. They're treating every lead the same way, whether it came from a $500 Google Ad click or a $5 Facebook lead.

What Proper Integration Actually Looks Like

Successful firms create tight feedback loops with their agencies. Here's what that means in practice:

Lead Quality Scoring - Your intake team grades every single lead on a consistent scale. Not just "signed" or "didn't sign," but detailed scoring: Was this a case you'd take? Did they have a legitimate injury? Were they in your service area? Was there clear liability? This feedback gets sent back to your agency weekly.

Source Attribution - Every lead is tagged with exactly where it came from. Not just "Google Ads" but which specific campaign, ad group, and keyword. This level of detail allows your agency to cut spending on sources producing rubbish leads and double down on sources producing cases you actually want.

Closed Loop Reporting - Your agency doesn't just see that someone filled out a form. They see that person became a client, what type of case it was, and eventually what it settled for. This is how agencies learn which marketing efforts actually generate revenue, not just activity.

Regular Strategy Sessions - You're not getting a monthly report emailed to you. You're having actual conversations about what's working. Your agency presents data, you provide context from the intake side, and together you make strategic decisions about where to invest.

This integration turns marketing from a guessing game into a science. Your agency can optimise for the outcomes you actually care about instead of vanity metrics that mean nothing.

Your Intake Process Is Part of Your Marketing

Here's something most firms don't want to hear: if your marketing isn't working, your intake process might be the problem, not your agency.

You can have the best marketing campaign in the world, generating perfect leads from people with serious injuries and clear liability. But if your intake team doesn't answer the phone, doesn't follow up quickly, or doesn't know how to convert a call into a signed client, those leads are worthless.

Think about the economics here. You might be spending $200 per lead for high-quality motor vehicle accident prospects. If your intake process only converts 10% of them, your CAC per signed client is $2,000. But if you improve your intake and convert 30% of those same leads, your CAC drops to $666. That's the same marketing spend generating triple the clients.

Your intake process needs to support the leads your agency is sending. This means:

Speed - Research consistently shows that responding within the first hour dramatically increases conversion rates. If your intake team is getting around to calling leads back two days later, you're hemorrhaging money. Your competitors are signing those clients while your leads sit in a queue.

Volume Capacity - If your agency successfully ramps up lead volume but your intake team can't handle the increase, what have you gained? You need enough intake capacity to manage the leads you're paying for. Otherwise you're literally paying for leads that never get called.

Quality Conversations - Your intake team needs to be trained in sales, not just data collection. They should understand how to build rapport, address objections, and move prospects toward signing. A case coordinator who reads from a script and asks questions robotically will convert at a fraction of the rate of someone who actually knows how to sell.

Follow-Up Systems - Most prospects don't sign on the first call. They need to think about it, talk to family, or finish dealing with immediate medical concerns. Without a systematic follow-up process—automated emails, scheduled callbacks, text reminders—you'll lose these cases to firms that actually stay in touch.

The Data Your Intake Team Should Be Tracking

If you want your agency to optimise for actual results, your intake team needs to be feeding them detailed data:

Lead source (which campaign, ad, keyword)

Lead quality score (on a consistent 1-5 scale)

Case type and estimated value

Response time (how quickly was the lead contacted)

Number of contact attempts before connection

Signed vs not signed (and why if not signed)

Retention vs referred out

This data transforms your agency from reactive to proactive. Instead of guessing what works, they have hard evidence about which marketing investments generate profitable cases.

The Technical Setup: Making CAC:LTV Tracking Actually Work

Talking about CAC:LTV ROI is easy. Actually tracking it properly requires specific systems and processes.

Here's what you need to have in place:

1. Proper Call Tracking

Every phone number in your marketing needs to be tracked. Not just "phone calls from Google Ads" but calls from specific campaigns and keywords. Call tracking platforms like CallRail, CallTrackingMetrics, or Invoca can handle this by generating unique phone numbers for different marketing sources.

But call tracking alone isn't enough. You need call recording and analysis so you can:

Review actual conversations to see why leads are or aren't converting

Coach your intake team on better approaches

Identify which marketing sources generate the best quality conversations

Catch intake mistakes before they become patterns

2. CRM Integration

Your customer relationship management system needs to integrate with your marketing tools. This allows you to:

Automatically capture leads from ads, forms, and calls into one central database

Track every touchpoint with each prospect

See which marketing sources each client came from

Measure time-to-conversion and contact attempts

Calculate actual CAC by source

Popular legal CRMs like Clio, Lawmatics, or MyCase all offer these capabilities, but they're useless unless you actually use them consistently.

3. Marketing Platform Access

Your agency needs access to your call tracking and CRM data, not just exports you send them monthly. This real-time access allows them to:

See lead quality as it comes in and adjust campaigns immediately

Identify problems before you've wasted thousands on low-quality sources

Test and optimise based on actual conversion data, not just clicks

Report on metrics that actually matter to your business

Most firms are hesitant to give agencies this level of access. I understand the instinct to protect your data. But if you don't trust your agency enough to share performance data, you've hired the wrong agency.

4. Conversion Tracking Setup

For digital advertising to optimise properly, conversion events need to be tracked. This means:

Form submissions tagged with proper tracking codes

Phone calls logged with source attribution

Signed clients reported back to ad platforms when possible

Value data (settlement amounts) fed back for advanced optimisation

Meta Ads, Google Ads, and other platforms can use this conversion data to automatically find more prospects similar to the ones who actually become clients. But they need accurate data to learn from.

The Feedback Loop That Actually Works

Here's what a proper agency-firm integration looks like in practice:

Monday: Your agency reviews last week's lead data. They see that leads from the "motor vehicle accident" campaign in Melbourne's western suburbs are converting at 35%, while leads from the "slip and fall" campaign in the CBD are converting at 8%.

Tuesday: They shift $3,000 per week from the underperforming campaign to the one that's working. They also notice the western suburbs leads have an average settlement value 2.5x higher than the CBD leads.

Wednesday: Your intake manager reports that three leads from Thursday last week haven't been reached despite five call attempts. The agency checks the lead source and sees these came from a new ad that's generating junk traffic. They pause the ad immediately.

Thursday: You have a strategy call with your agency. They present data showing your CAC for motor vehicle cases is $2,100 with an average LTV of $52,000 (24:1 ratio). Your CAC for workplace injury cases is $3,800 with an average LTV of $41,000 (11:1 ratio). Together, you decide to increase investment in motor vehicle advertising and reduce workplace injury spend.

Friday: The agency implements the changes. They create new ad variations targeting different suburbs in the western region and increase daily budget on the best-performing campaigns.

This is how marketing actually improves over time. Not through guesswork or "industry best practices," but through systematic testing, measurement, and optimisation based on what actually drives revenue for your specific firm.

Common Excuses (And Why They're Wrong)

Let me address some pushback I typically hear from firms:

"Our cases take too long to settle to measure CAC:LTV accurately."

True, personal injury cases can take 12-24 months to resolve. But you can use historical data and estimates. If your average case settles for $180,000 and you take a 33% fee, your estimated LTV is $60,000. As cases settle, you update with actual numbers. The key is to start tracking now, not waiting until you have "perfect" data.

"We don't have the resources to track all this."

You're already spending tens of thousands per month on marketing. Investing $1,000-$2,000 per month in proper tracking tools and processes isn't optional—it's essential. The alternative is continuing to make decisions blind and waste money on ineffective marketing.

"Our agency handles all this for us."

No they don't. Unless you have daily communication, shared access to systems, and detailed conversion data flowing both ways, you're not properly integrated. Agencies can optimise what they can see, but they can't see what you don't share.

"We track leads in a spreadsheet, that's good enough."

It's not. Spreadsheets are manual, error-prone, and impossible to integrate with marketing platforms. They also create information silos where your intake team has data your agency needs but never sees. Proper CRM and call tracking systems aren't optional for serious firms.

What To Do Starting Today

If you're reading this and realising your marketing measurement is a mess, here's where to start:

Week 1: Audit Your Current Tracking

Do you know your actual CAC for the last three months? Calculate it by adding all marketing and sales costs and dividing by clients signed

Do you know your average LTV by case type? Look at your last 50 settled cases and calculate average settlement amounts by category

Can you attribute each signed client to a specific marketing source? If not, you have a data problem

Are you tracking lead quality, or just counting leads? Start implementing a 1-5 scoring system for intake calls

Week 2: Get Your Systems Right

Implement proper call tracking if you haven't already

Get your CRM set up properly and integrated with your marketing tools

Make sure every marketing source has unique tracking so you can attribute conversions

Set up a system for your intake team to report lead quality data weekly

Week 3: Create the Feedback Loop

Schedule a meeting with your agency to discuss CAC:LTV ROI tracking

Give them access to your call tracking and CRM systems

Establish a weekly reporting cadence where they receive lead quality data

Set up monthly strategy sessions to review performance and optimise spending

Week 4: Start Optimising

Review which marketing sources have the best CAC:LTV ratios

Cut or reduce spending on sources that aren't working

Double down on sources generating profitable clients

Test new variations to improve performance of your best campaigns

The Reality Check

Most personal injury firms will read this article and do nothing.

They'll nod along, agree that CAC:LTV ROI is important, maybe even forward it to their marketing agency. Then they'll go right back to looking at impressions and traffic numbers because that's easier than doing the hard work of proper integration and tracking.

Here's what that costs them: thousands of dollars per month spent on marketing that isn't working, opportunities missed because they're not optimising for the right metrics, and growth that never happens because they can't figure out what's actually driving results.

The firms that actually implement this stuff? They're the ones that grow predictably, scale profitably, and eventually dominate their markets. Not because they have bigger budgets or better ads, but because they know what's working and they do more of it.

Marketing isn't magic. It's math. Track the right numbers, create proper feedback loops between your firm and your agency, optimise for actual revenue rather than vanity metrics, and your marketing will start working.

Everything else is just expensive guessing.

Ready to Fix Your Marketing Measurement?

If you're spending money on marketing but can't tell me your CAC:LTV ratio off the top of your head, we need to talk.

At PixelRush, we don't just generate leads—we build systematic client acquisition machines. That means proper tracking, detailed reporting on actual ROI, and tight integration between our campaigns and your intake process.

We only work with firms that are serious about tracking real metrics and optimising for profit, not vanity numbers. If that's you, book a strategy call and let's see if we're a fit.

No fluff, no generic advice, just a straight conversation about what's working, what's not, and how to fix it.